1. Credit 데이터셋

import numpy as np

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

credit_df = pd.read_csv('/content/drive/MyDrive/KDT v2/머신러닝과 딥러닝/ data/credit.csv')

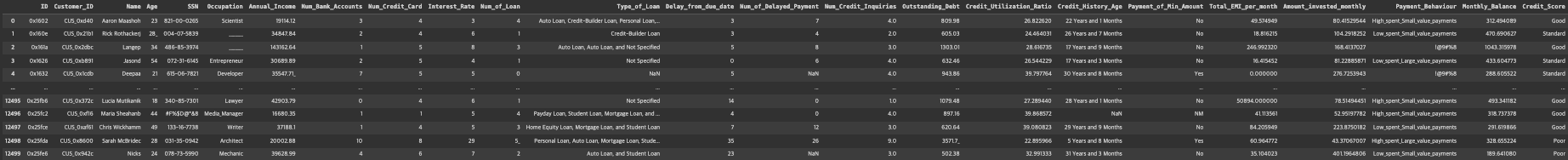

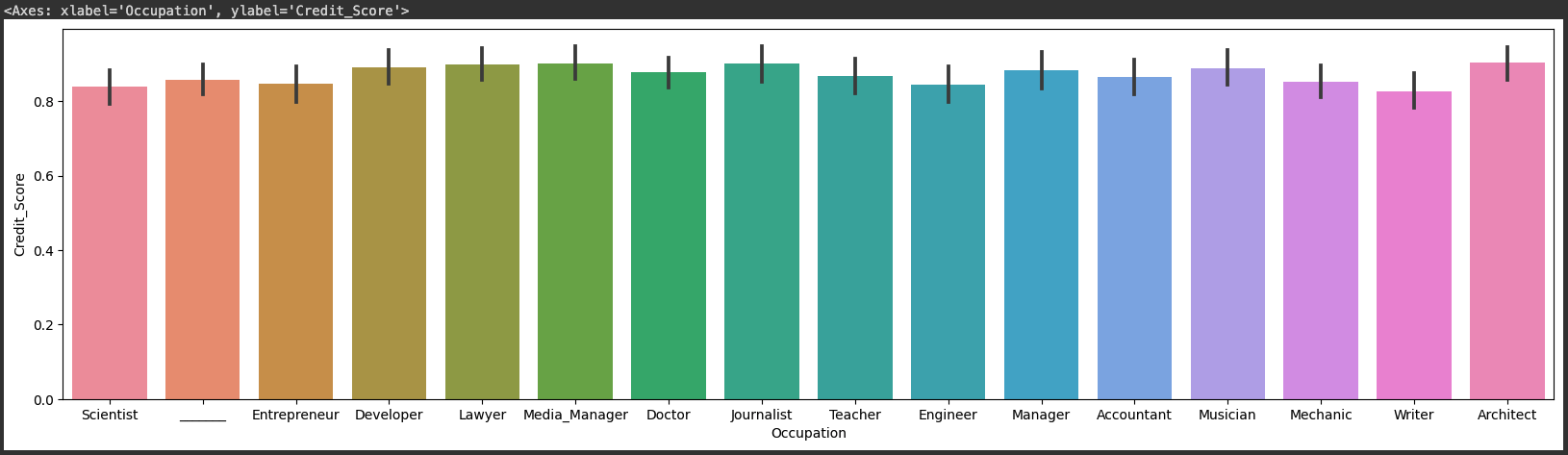

credit_df

# 컬럼의 최대치를 50으로 설정

pd.set_option('display.max_columns', 50)

# 정보 확인

credit_df.info()

# # Column Non-Null Count Dtype

# --- ------ -------------- -----

# 0 ID 12500 non-null object

# 1 Customer_ID 12500 non-null object

# 2 Name 11273 non-null object

# 3 Age 12500 non-null object

# 4 SSN 12500 non-null object

# 5 Occupation 12500 non-null object

# 6 Annual_Income 12500 non-null object

# 7 Num_Bank_Accounts 12500 non-null int64

# 8 Num_Credit_Card 12500 non-null int64

# 9 Interest_Rate 12500 non-null int64

# 10 Num_of_Loan 12500 non-null object

# 11 Type_of_Loan 11074 non-null object

# 12 Delay_from_due_date 12500 non-null int64

# 13 Num_of_Delayed_Payment 11657 non-null object

# 14 Num_Credit_Inquiries 12264 non-null float64

# 15 Outstanding_Debt 12500 non-null object

# 16 Credit_Utilization_Ratio 12500 non-null float64

# 17 Credit_History_Age 11387 non-null object

# 18 Payment_of_Min_Amount 12500 non-null object

# 19 Total_EMI_per_month 12500 non-null float64

# 20 Amount_invested_monthly 11935 non-null object

# 21 Payment_Behaviour 12500 non-null object

# 22 Monthly_Balance 12366 non-null float64

# 23 Credit_Score 12500 non-null object한/영 변환

| English | 한글 |

|---|---|

| ID | 고유 식별자 |

| Customer_ID | 고객 ID |

| Name | 이름 |

| Age | 나이 |

| SSN | 주민등록번호 |

| Occupation | 직업 |

| Annual_Income | 연간 소득 |

| Num_Bank_Accounts | 은행 계좌 수 |

| Num_Credit_Card | 신용 카드 수 |

| Interest_Rate | 이자율 |

| Num_of_Loan | 대출 수 |

| Type_of_Loan | 대출 유형 |

| Delay_from_due_date | 마감일로부터 연체 기간 |

| Num_of_Delayed_Payment | 연체된 결제 수 |

| Num_Credit_Inquiries | 신용조회 수 |

| Outstanding_Debt | 미상환 잔금 |

| Credit_Utilization_Ratio | 신용카드 사용률 |

| Credit_History_Age | 카드 사용 기간 |

| Payment_of_Min_Amount | 리볼빙 여부 |

| Total_EMI_per_month | 월별 총 지출 금액 |

| Amount_invested_monthly | 매월 투자 금액 |

| Payment_Behaviour | 지불 행동 |

| Monthly_Balance | 월별 잔고 |

| Credit_Score | 신용 점수 |

credit_df.drop({'ID', 'Customer_ID', 'Name', 'SSN'}, axis=1, inplace=True)

credit_df['Credit_Score'].value_counts()

# 결과 =>

# Standard 6943

# Poor 3582

# Good 1975

# Name: Credit_Score, dtype: int64

credit_df['Credit_Score'] = credit_df['Credit_Score'].replace({'Poor':0, 'Standard':1, 'Good':2})

credit_df.describe()

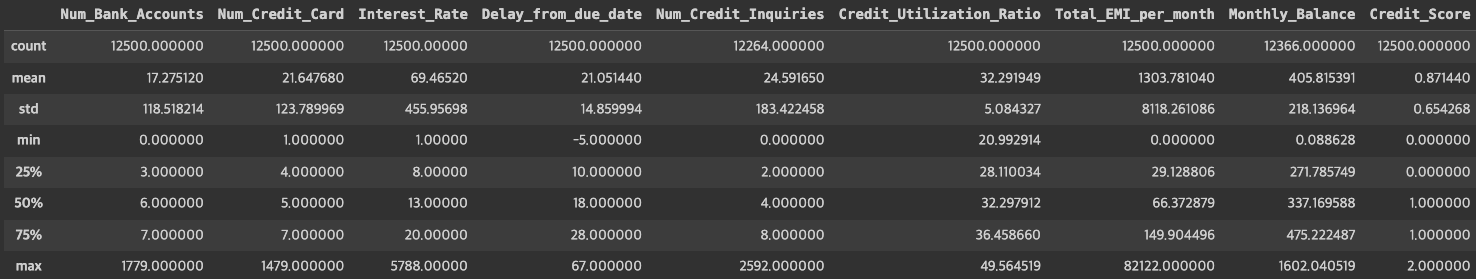

sns.barplot(x='Payment_of_Min_Amount', y='Credit_Score', data=credit_df)

plt.figure(figsize=(20, 5))

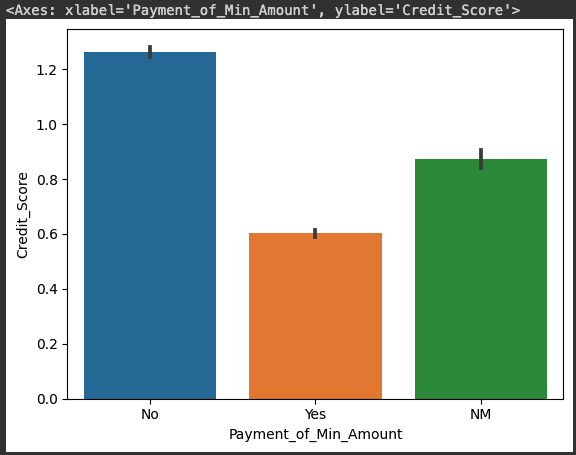

sns.barplot(x='Occupation', y='Credit_Score', data=credit_df)

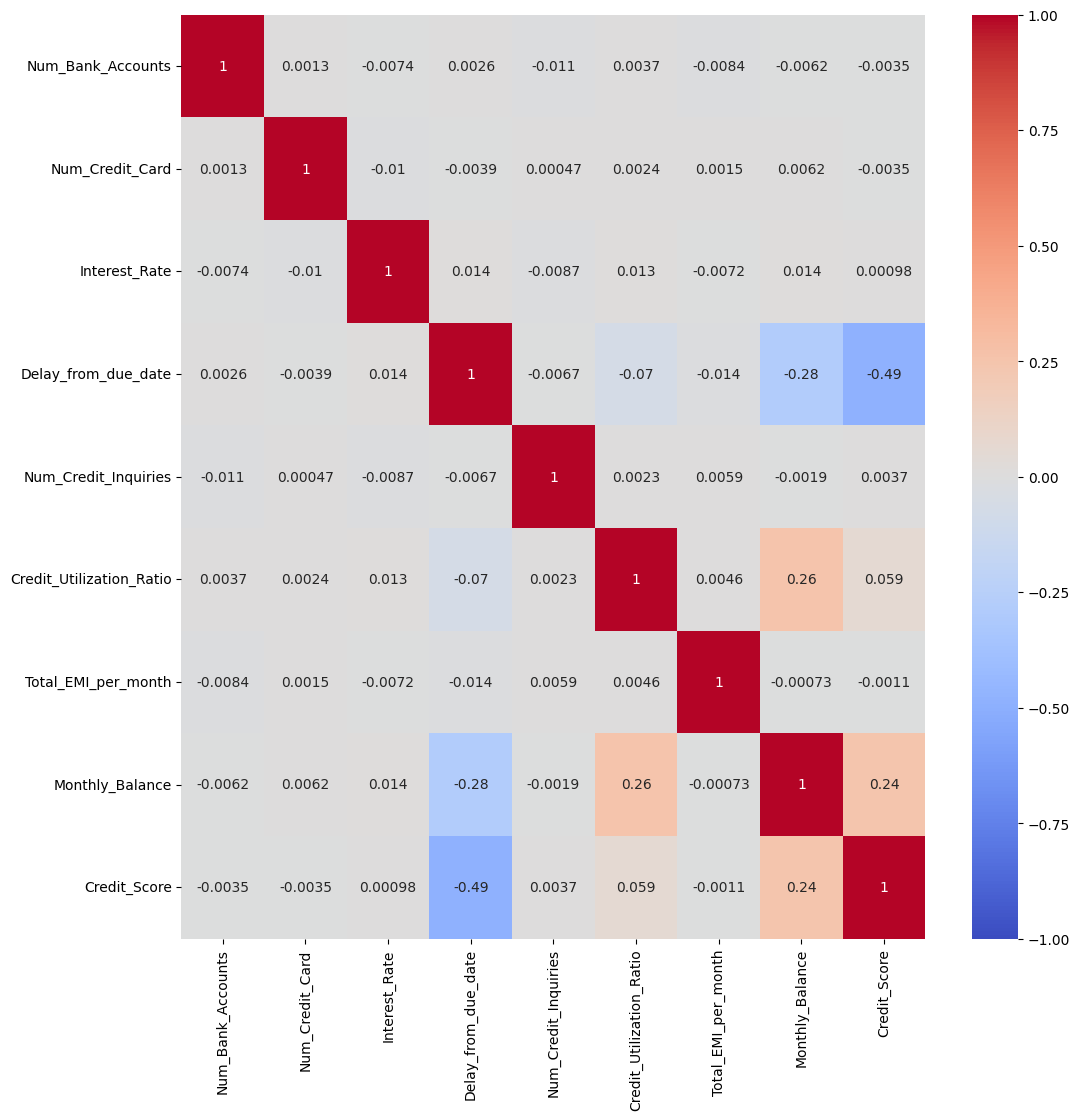

plt.figure(figsize=(12, 12))

sns.heatmap(credit_df.corr(), cmap='coolwarm', vmin=-1, vmax=1, annot=True)

for i in credit_df.columns:

if credit_df[i].dtype == 'O':

print(i)

# 결과값 =>

# Age

# Occupation

# Annual_Income

# Num_of_Loan

# Type_of_Loan

# Num_of_Delayed_Payment

# Outstanding_Debt

# Credit_History_Age

# Payment_of_Min_Amount

# Amount_invested_monthly

# Payment_Behaviour

# _를 제거

for i in ['Age', 'Annual_Income', 'Num_of_Loan', 'Num_of_Delayed_Payment', 'Outstanding_Debt', 'Amount_invested_monthly']:

credit_df[i] = pd.to_numeric(credit_df[i].str.replace('_', ''))

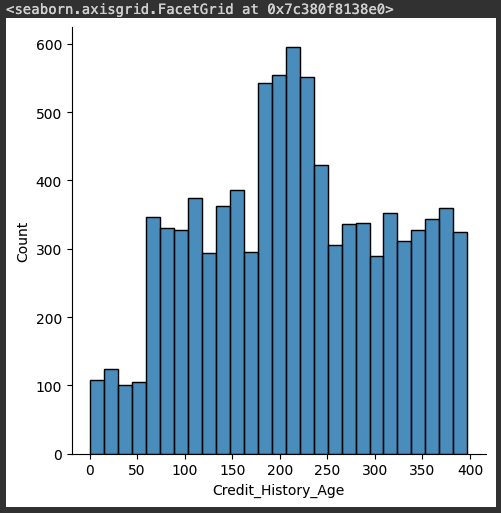

credit_df['Credit_History_Age'] = credit_df['Credit_History_Age'].str.replace(' Months', '')

credit_df['Credit_History_Age'] = pd.to_numeric(credit_df['Credit_History_Age'].str.split(' Years and ', expand=True)[0]) * 12 + pd.to_numeric(credit_df['Credit_History_Age'].str.split(' Years and ', expand=True)[1])

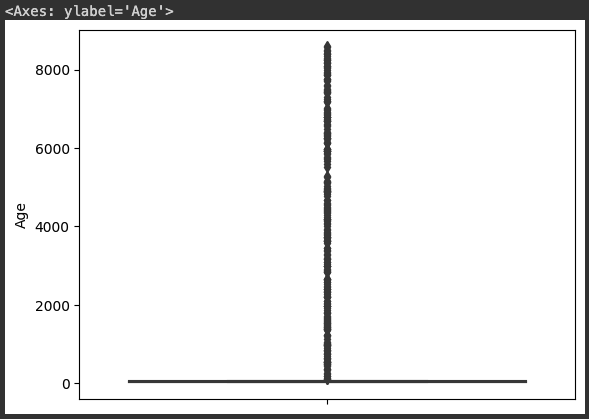

credit_df = credit_df[credit_df['Age'] >= 0]

sns.boxplot(y=credit_df['Age'])

credit_df = credit_df[credit_df['Age'] < 110]

credit_df = credit_df[credit_df['Num_Bank_Accounts'] <= 10]

credit_df=credit_df[credit_df['Num_Credit_Card']<=20]

credit_df = credit_df[credit_df['Interest_Rate'] <= 40]

credit_df = credit_df[(credit_df['Num_of_Loan'] <= 10) & (credit_df['Num_of_Loan'] >= 0)]

credit_df = credit_df[credit_df['Delay_from_due_date'] >= 0]

credit_df = credit_df[(credit_df['Num_of_Delayed_Payment'] <= 30) & (credit_df['Num_of_Delayed_Payment'] >= 0)]

credit_df['Num_Credit_Inquiries'] = credit_df['Num_Credit_Inquiries'].fillna(0)

sns.displot(credit_df['Credit_History_Age'])

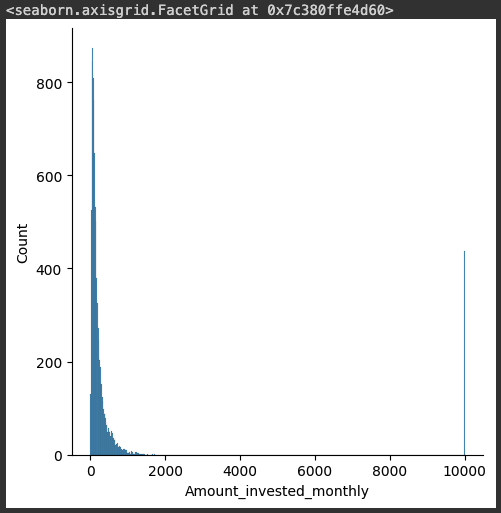

sns.displot(credit_df['Amount_invested_monthly'])

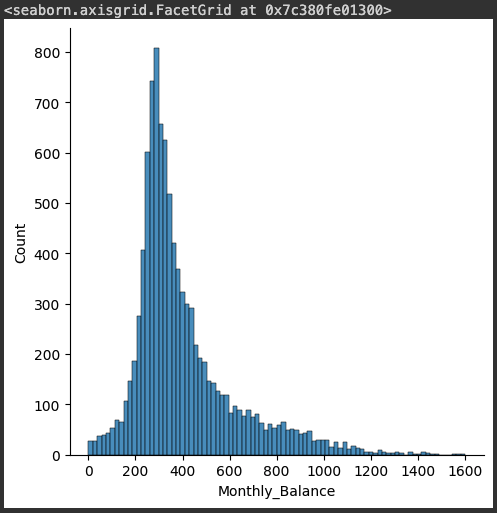

sns.displot(credit_df['Monthly_Balance'])

credit_df = credit_df.fillna(credit_df.median())

credit_df.isna().mean()

# 결과값 =>

# Age 0.000000

# Occupation 0.000000

# Annual_Income 0.000000

# Num_Bank_Accounts 0.000000

# Num_Credit_Card 0.000000

# Interest_Rate 0.000000

# Num_of_Loan 0.000000

# Type_of_Loan 0.111056

# Delay_from_due_date 0.000000

# Num_of_Delayed_Payment 0.000000

# Num_Credit_Inquiries 0.000000

# Outstanding_Debt 0.000000

# Credit_Utilization_Ratio 0.000000

# Credit_History_Age 0.000000

# Payment_of_Min_Amount 0.000000

# Total_EMI_per_month 0.000000

# Amount_invested_monthly 0.000000

# Payment_Behaviour 0.000000

# Monthly_Balance 0.000000

# Credit_Score 0.000000

credit_df['Type_of_Loan'] = credit_df['Type_of_Loan'].str.replace('and ', '')

# No Loan이라는 필드를 생성

credit_df['Type_of_Loan'] = credit_df['Type_of_Loan'].fillna('No Loan')

type_list = set(credit_df['Type_of_Loan'].str.split(', ').sum())

type_list

# 결과값 =>

# {'Auto Loan',

# 'Credit-Builder Loan',

# 'Debt Consolidation Loan',

# 'Home Equity Loan',

# 'Mortgage Loan',

# 'No Loan',

# 'Not Specified',

# 'Payday Loan',

# 'Personal Loan',

# 'Student Loan'}

for i in type_list:

credit_df[i] = credit_df['Type_of_Loan'].apply(lambda x: 1 if i in x else 0)

credit_df.drop('Type_of_Loan', axis=1, inplace=True)

credit_df['Occupation'].value_counts()

# 결과값 =>

# _______ 674

# Lawyer 664

# Mechanic 646

# Scientist 640

# Engineer 640

# Architect 633

# Teacher 624

# Developer 621

# Entrepreneur 620

# Media_Manager 616

# Accountant 611

# Doctor 608

# Musician 607

# Journalist 606

# Manager 602

# Writer 592

# Name: Occupation, dtype: int64

credit_df['Occupation'] = credit_df['Occupation'].replace('_______', 'Unknown')

credit_df['Payment_Behaviour'].value_counts()

# 결과값 =>

# Low_spent_Small_value_payments 2506

# High_spent_Medium_value_payments 1794

# High_spent_Large_value_payments 1453

# Low_spent_Medium_value_payments 1376

# High_spent_Small_value_payments 1136

# Low_spent_Large_value_payments 995

# !@9#%8 744

# Name: Payment_Behaviour, dtype: int64

credit_df['Payment_Behaviour'] = credit_df['Payment_Behaviour'].str.replace('!@9#%8', 'Unknown')

credit_df = pd.get_dummies(credit_df, columns={'Occupation', 'Payment_of_Min_Amount', 'Payment_Behaviour'})

from sklearn.model_selection import train_test_split

X_train, X_test, y_train, y_test = train_test_split(credit_df.drop('Credit_Score', axis=1), credit_df["Credit_Score"], test_size=0.2, random_state=2023)

X_train.shape, y_train.shape

# 결과값 => ((8003, 51), (8003,))

X_test.shape, y_test.shape

# 결과값 => ((2001, 51), (2001,))

lightGBM(LGBM)

- Microsoft에서 개발한 Gradient Boosting Framework

- 리프 중심 히스토그램 기반 알고리즘

- GBM(Gradient Boosting Model) : 모델1을 통해 y를 예측하고, 모델2에 데이터를 넣어 y를 예측하고, 모델3에 넣어 y를 예측하는 방식

- 작은 데이터셋에서도 높은 성능을 보이며, 특히 대용량 데이터셋에서 다른 Gradient Boosting 알고리즘보다 빠르게 학습.

- 메모리 사용량이 상대적으로 적은편

- 적은 데이터셋을 사용할 경우 과적합 가능성이 매우 큼(일반적으로 데이터가 10,000개 이상은 사용 해야함)

- 조기 중단(early stopping)을 지원

리프 중심 히스토그램 기반 알고리즘

- 트리를 균형적으로 분할하는 것이 아니라, 최대한 불균형하게 분할

- 특성들의 분포를 히스토그램으로 나타내고, 해당 히스토그램을 이용하여 빠르게 후보 분할 기준을 선택

- 후보 분할 기준 중에서 최적의 분할 기준을 선택하기 위해, 데이터 포인트들을 히스토그램에 올바르게 배치하고, 이용하여 최적의 분할 기준을 선택

from lightgbm import LGBMClassifier

base_model = LGBMClassifier(random_state=2023)

base_model.fit(X_train, y_train)

pred = base_model.predict(X_test)from sklearn.metrics import accuracy_score, confusion_matrix, classification_report, roc_auc_score

accuracy_score(y_test, pred)

# 결과값 => 0.7251374312843578

confusion_matrix(y_test, pred)

# 결과값 =>

# array([[409, 144, 25],

# [154, 855, 108],

# [ 4, 115, 187]])print(classification_report(y_test, pred))

# 결과값 =>

# precision recall f1-score support

#

# 0 0.72 0.71 0.71 578

# 1 0.77 0.77 0.77 1117

# 2 0.58 0.61 0.60 306

#

# accuracy 0.73 2001

# macro avg 0.69 0.69 0.69 2001

# weighted avg 0.73 0.73 0.73 2001

proba = base_model.predict_proba(X_test)

# 클래스가 3개 이상이므로 그냥 (y_test, proba)만 적으면 에러가 발생한다.

# 그러므로 multi_class='ovr'옵션을 추가하여 값을 추출한다.

roc_auc_score(y_test, proba, multi_class='ovr')

# 결과값 => 0.8932634160489487

'Study > 머신러닝과 딥러닝' 카테고리의 다른 글

| [머신러닝과 딥러닝] 12.KMeans (1) | 2024.01.08 |

|---|---|

| [머신러닝과 딥러닝] 11. 다양한 모델 적용 (0) | 2024.01.08 |

| [머신러닝과 딥러닝] 9. 랜덤 포레스트 (0) | 2024.01.03 |

| [머신러닝과 딥러닝] 8. 서포트 백터 머신 (0) | 2024.01.02 |

| [머신러닝과 딥러닝] 7. 로지스틱 회귀 (0) | 2024.01.02 |